How much mortgage can you borrow based on salary

When it comes to calculating affordability your income debts and down payment are primary factors. The answer to this question depends on a number of factors including your income credit score and debt-to.

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Depending on a few personal circumstances you could get a mortgage.

. How much mortgage can I borrow with my salary. Calculate what you can afford and more. Looking For A Mortgage.

Check Your Eligibility for a Low Down Payment FHA Loan. Mortgage lenders in the UK. Take the First Step Towards Your Dream Home See If You Qualify.

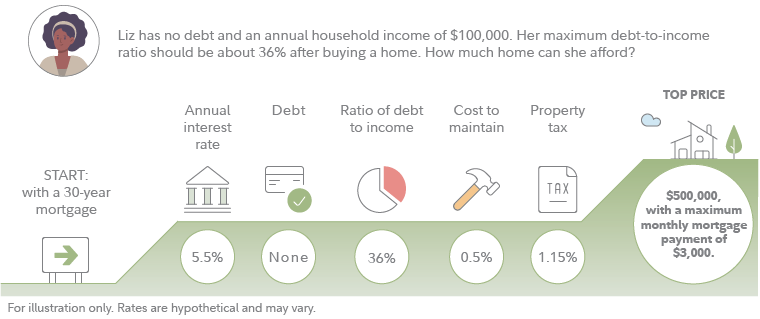

Enter your salary below combined salaries for a joint application to see how much you could potentially borrow. Experts recommend that the monthly cost of the loan should not exceed 30 of the buyers income. The 2836 rule is a common rule of.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Thats a 120000 to 150000 mortgage at 60000.

Get Started Now With. Most lenders cap the amount you can borrow at just under five times your yearly wage. Ad Top-Rated Mortgage Lenders 2022.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. In a practical example.

This would usually be based. See How Much You Can Save. Ad First Time Home Buyers.

Suddenly the maximum amount they can borrow on their salary drops to 471000 or 47 times their salary. The higher mortgage rate has reduced their home buying. Were Americas 1 Online Lender.

How much you can borrow is based on your debt-to-income ratio. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Looking For A Mortgage.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. What mortgage can I. Generally lend between 3 to 45 times an individuals annual income.

Its A Match Made In Heaven. Find out more about the fees you may need to pay. How Much Can I Borrow for a Mortgage Based on My Income Fha.

You typically need a minimum deposit of 5 to get a mortgage. For instance if your annual income is 50000 that means a lender. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income.

For you this is x. How Much Can I Borrow for a Mortgage Based on My Income. Its A Match Made In Heaven.

Were Americas 1 Online Lender. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. How much you can borrow is based on your debt-to-income ratio.

How much house you can afford is also dependent on. The debt-to-income ratio DTI is your minimum monthly debt divided by your gross monthly income. What More Could You Need.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Factors that impact affordability. Mortgage Affordability Calculator.

You need to make 138431 a year to afford a 450k mortgage. How much can you borrow. Compare Mortgage Options Get Quotes.

How much do you have for your deposit. This is the percentage of your monthly income that goes towards your debts. What More Could You Need.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Your salary will have a big impact on the amount you can borrow for a mortgage. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

As the table below. The maximum you can borrow. These are your monthly income usually salary and your.

The Trusted Lender of 300000 Veterans and Military Families. This would usually be based on 4-45 times your annual. You could borrow up to.

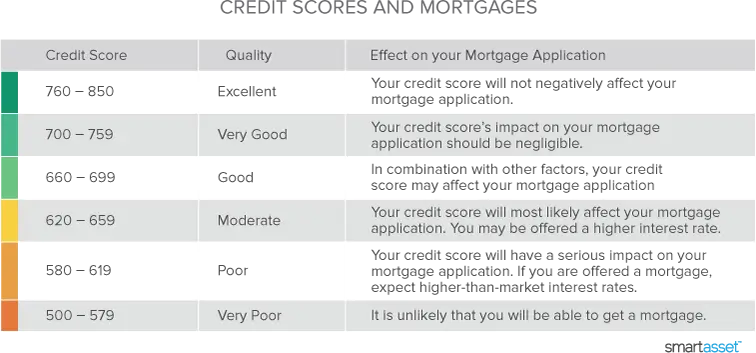

The maximum debt to income ratio borrowers can have is 50 on conventional loans. The Canstar research team crunched the numbers to show you how much you can afford to borrow on various salaries if you want to avoid mortgage stress. When mortgage lenders are trying to determine how much theyll let you borrow your debt-to-income ratio DTI is a standard barometer.

Salary Needed To Afford Home Payments In The 15 Largest Cities Smartasset Mortgage Payoff Mortgage Humor Best Mortgage Lenders

Mortgage Process Home Buying Process Mortgage Loans

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Do S Dont S Mortgage Lenders Buying First Home Mortgage Loans

Pin By Akbanknotes On Loan Applications Mortgage Process Mortgage Loan Originator Mortgage Loans

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

How Much House Can I Afford Bhhs Fox Roach

Improve Your Home With These Fantastic Guidelines Home Buying Home Buying Tips Home Mortgage

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Mortgage Dos And Don Ts Bank Account Mortgage Home Buying Process Mortgage Process

How Much Mortgage Can I Afford Smartasset Com

How Much House Can I Afford Fidelity

Mortgage Banker Vs Mortgage Broker

How Much Mortgage Can You Afford Based On Your Salary Income And Assets Cbs News

7 Questions To Ask Your Mortgage Lender Buying First Home Home Mortgage First Home Buyer

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Things To Consider When Choosing Between Renting Or Buying A House Preapproved Mortgage Mortgage Corporate Brochure Cover